| Hello and welcome to your updated board briefing. I would love to hear your thoughts on the changes we’ve made so please do hit reply and let me know what you think. We’ve introduced a new section – AOB – where I highlight any nuggets of wisdom or wit that I’ve come across. Overheard a boardroom insight that you’d like to share? Email me your offering and I will consider it for inclusion – anonymised where appropriate, of course. Don’t miss two upcoming exclusive events for Board Network members: May 23, London | Roundtable: Hybrid working as the ‘new normal’ Discuss the challenges and opportunities with Board Network peers. This event is for VIP members only. If you’d like to attend, please contact [email protected]. June 6, Virtual | The rise of cyber attacks: how prepared is your business? Join experts including Ciaran Martin, founding chief executive of the National Cyber Security Centre and professor at the University of Oxford. RSVP here.

And if you want to catch up on our session about power dynamics with Harvard Business School’s Linda Hill, the highlights are available now. As always, the latest stories and resources are on ft.com/board-network-members. If you have any membership queries, email [email protected]. And feel free to forward this newsletter to other directors. They can join FT Board Network via ft.com/board-network. Thanks for reading. Succession at Berkshire Hathaway

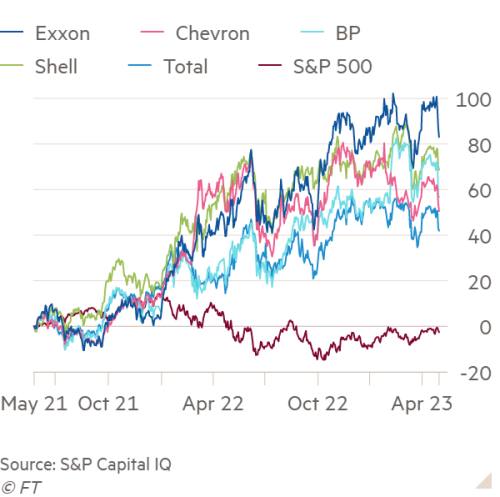

Greg Abel, centre, with shareholders at Berkshire Hathaway’s annual meeting this weekend © Reuters/Bloomberg I once wrote how “ageing financial titans”, including legendary investor Warren Buffett, were having to consider their own mortality. That 2002 article is now so aged that FT.com cannot retrieve an online version, but Buffett, now 92, and his sidekick, 99-year-old Charlie Munger, soldier on at the head of investment group Berkshire Hathaway. The duo were onstage again last weekend in Omaha for the Berkshire annual meeting - dubbed the “Woodstock of capitalism” - with tens of thousands of investors hanging on their every word. Berkshire is far from a conventional company, so drawing any broad governance conclusions from their stewardship might be risky. Two things did strike me 20 years ago, however, and are still valid now. One is the value of good, open communication with shareholders. Few listed companies can count on such fervent investor loyalty, of course. But boards might win more of them over by taking a leaf out of the Buffett/Munger playbook. The formal business of the annual shareholder meeting is usually confined to two or three minutes; the meat (and the jokes) come in the question and answer session. The second lesson is the critical need to keep succession plans up to date. Potential successors to Buffett and Munger have come and gone since I last visited Omaha. Greg Abel, who runs Berkshire’s non-insurance businesses, is now the anointed one. He was more prominent than ever at this year’s event, appearing onstage with Munger and Buffett and playing the continuity card. “The framework has been laid out,” he said. “We know how . . . you [Buffett] and Charlie have approached it and [I] really don’t see that framework changing.” Buffett himself admitted there was no alternative to Abel. If I were a Berkshire director, that would make me a little nervous. Succession plans are like insurance policies: you need to review them every year. Chart of the weekIn 2021 ExxonMobil faced a full-blown investor uprising about its approach to climate change. Two years on, the question is: has the oil major really changed? Is there a genuine pivot in Exxon’s beliefs and strategy? Or is it just a clever way to drum up some positive PR and cash in on the Biden administration’s green subsidies? Exxon’s shares have beat rivals since boardroom defeatPerformance vs oil majors and S&P 500 (% change since end-May 2021)

| HSBC shareholders reject Ping An-backed split proposal at AGM | | Proxy season: Mark Tucker, HSBC’s pugnacious chair, would like this to be the last he hears of major investor Ping An’s attempt to push through an east-west split of the banking group, but my bet is the Chinese insurer is not going to go quiet just yet. | |  | Does it pay for British executives to move to the US? | | Remuneration: That sucking sound is the gravitational pull of higher pay in the US, luring the UK’s chief executives, who are starting to get fed up with investors’ criticism of their compensation. | |  | Chegg is a harbinger of AI’s disruptive force | | Technology: A drop in the share price of online education group Chegg - hit by fears that generative AI would rob it of its revenues - sent ripples of fear round the world. But did Wall Street jump the gun? | |  | Government adviser calls for Post Office board to resign | | Effective oversight: The repercussions of the sub-postmaster scandal continue to shake the Post Office, with one Conservative peer claiming this week that “nobody on the board of directors read the accounts”. | | | | | Best from elsewhereSuperstar CEOs and corporate law | Harvard Law School Forum on Corporate Governance An interesting article that outlines the challenge of governing superstar leaders like Elon Musk. One notable point is that such star power is limited in “duration and magnitude”. It will probably evaporate if “markets lose faith” and boards will keep leaders from abusing their power (though only if the possible harm is greater than their contribution to the company’s value). Do activist investors boost shareholder returns? | Goldman Sachs Investors often want to unlock value, but this research suggests the results of activist campaigns amongst US companies are “mixed”. The median results showed an initial uptick in performance, followed by a drop in the longer term. But the average target did outperform its sector by four percentage points after one year. Board effectiveness: a survey of the C-suite | PwC This report looks at how executives at public companies in the US rate the performance of their directors. An eye-watering 89 per cent said they thought one or more directors should be given the boot – a percentage that is consistent with last year’s results.

From FT Specialist’s AgendaCybersecurity expertise sets US boards apart, as the UK lags AOBIn a memo to staff, UBS chief Sergio Ermotti warned there could be some fraught moments as they undertake the herculean task of integrating Credit Suisse. Have words of wisdom to share? Email me. |